Payday loan applications get assessed by lenders in a different way to mortgages, car and personal loans, and even credit card eligibility. The 'no credit check' element of payday loan approval is more to do with the fact that payday lenders don't base decisions on what banks do. Payday loans are designed to be an accessible route to shorter-term finance for a wide variety of borrowers. Lenders offering these loans look to your credit report more to fulfil their responsibility for borrower welfare. They'll check to see you haven't had an excessive amount of payday loans in the last few months, and for defaults on payday loans – but that's pretty much it.

The criteria for approval between the two lenders differ – and that's good news if you need a smaller loan and have less-than-perfect credit history. No credit check loans are funds issued by lenders that do not conduct a hard credit inquiry to review borrower's credit history. Instead of pulling an applicant's credit report, no credit check lenders look at income, bank information and a range of other criteria. These loans can come in the form of installment loans, payday loans, lines of credit, personal loans or a variety of other lending products. Ultimately, we hope to provide you with the information you need to decide whether any no credit check loans in the UK that you may come across are the best choice for your finances.

We know how hard it is to find affordable no credit check loans, especially with bad credit history. At Slick Cash Loan, we can help you get the money you need in a short time and without any hassle. We offer a high approval rate for payday loans and personal installment loans for people with bad credit scores. Bad credit loans are financing options offered to individuals with low credit scores of 669 or less. Although there are many types of bad credit loans, the most common is an unsecured personal loan. Unsecured personal loans for bad credit often carry monthly repayment terms of no more than two to seven years with a fixed interest rate.

Plus, this type of bad credit loan is quick to get, as many lenders offer next-day funding. It's been around since 1998, offering easily accessible loan options for people with all types of backgrounds. It provides auto loans, bad credit loans, personal loans, and student loans. Furthermore, the website is easy to use and encrypted to keep your personal information safe.

Having a low credit score can make it more difficult to be approved for credit, and this can cause people to look for payday loans from direct lenders with no credit check. However, offering payday loans with no credit checks in the UK goes against the guidelines of the Financial Conduct Authority . No credit check or online payday loans are an excellent way to bypass bad credit scores and promptly get the money you need. Online loans save you the effort of driving around to get cash advances, nor do you have to worry about borrowing a high amount from shady lenders. Online lending marketplaces offer an easy way to access no credit check loans networks that are trustworthy. At Now Loan, we believe that bad or insufficient credit history should not be an insurmountable barrier to receiving the funds you need.

Some FCA authorised lenders on our panel share the same belief and offer a variety of no credit check loans suited to borrowers in the UK with less than stellar credit. We selected Avant as the overall best personal loan for bad credit because you can borrow up to $35,000 with a repayment period as long as 60 months. Plus, Avant uses a soft credit check to identify the loan options available to you, meaning you can see if you qualify without hurting your credit score. What's more, loan funds can be deposited in your account as soon as the next business day. No credit check signature loans don't require a hard inquiry into your credit reports. A hard inquiry can reduce your credit score by up to five points.

Loan companies that don't perform a hard inquiry conduct soft credit checks that are much less invasive and don't impact your credit score. When you decide on a lender that works for you, they may perform a hard credit check before you are approved for the loan. Most online lenders perform only a soft credit check which does not affect your credit history like hard checks. Your creditworthiness and ability to repay the loan are two main factors that lenders consider when applying for an unsecured loan with bad credit.

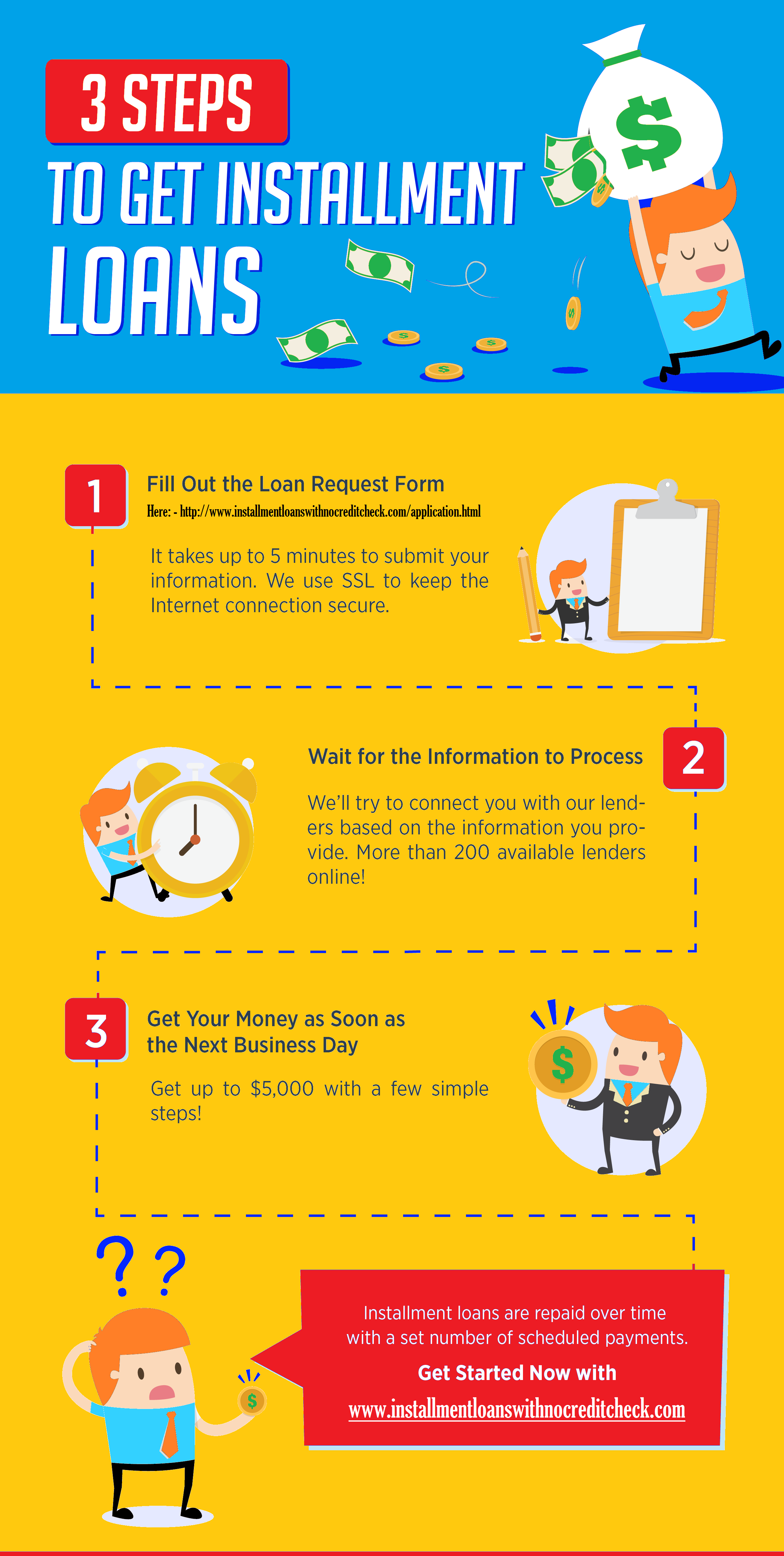

You can't afford a long wait – Fast access to cash can make the difference between staying current with on-time payments and falling behind on your bills between paydays. Small loans present no credit check delays, ensuring money is available when you need it. The simple online application takes only minutes to complete, before electronically submitting your loan request. The efficient approach leads to faster funding than many conventional alternatives, supporting short turnaround times for qualified applicants. Bank loans may require weeks to fund, whilst small online loans offer same-day service.

Upon acceptance for an online loan, your lending partner transfers money directly to your current account, allowing you to address personal spending priorities, without delays. To help you out with this, we have listed some companies that offer bad credit loans or unsecured personal loans with guaranteed approvals. Fortunately, these companies have pretty reasonable terms and do not ask for a kidney in return. Since most bad credit personal loan companies have extremely unaffordable interest rates, this was one of our biggest concerns when making this list. These days, people only help others if they're sure to get something in return. Although the companies on our list have varying terms and interest rates, all of them are fairly reasonable and trustworthy.

Moreover, they have an excellent user base and super active customer support. Payday loans are short-term, small-dollar loans (usually up to $500) that you repay once you receive your next paycheck, typically two to four weeks after you take out the loan. Many lenders don't require a credit check, which is often enticing for people with bad credit. Payday loans come with a ton of their own risks and sky-high fees. Consider other alternatives first, like personal loans or borrowing money from friends and family.

Maximum loan amounts are low compared to other lenders, but the low minimum amount and flexible repayment terms make it an accessible option for borrowers. However, as with many loans for subprime borrowers, Avant personal loans come with a price. Still, the platform earns top marks for borrowers with less than stellar credit who need quick access to funds. The operator of this website is not a lender, does not make credit decisions or broker loans. The operator of this website does not charge you fees for its service and does not represent or endorse any participating shorter-duration loan lender. Consumer reports or credit checks may be made by the lender through Equifax, Experian, TransUnion, or alternative providers.

You are not obligated to use this site and are not obligated to contract with any third-party lender or service provider. These disclosures are for informational purposes only and should not be considered legal advice. NOT A LENDER NOTICE The operator of this website is NOT a lender, does not make offers for loans, and does not broker online loans to lenders. This website is not a representative or agent of any lender and does not make credit decisions. Submission of a loan request to this website does not guarantee an offer or an approval for a loan Some lenders may require faxing of information. In some instances you may have to visit a physical store/branch location to complete your loan request process.

Please contact your lender directly with questions or issues regarding your loan. In accordance with FCA regulations, payday loans with no credit check from direct lenders are not permissible. For this type of loan, the lender would need to gather a sufficient amount of information to determine whether you would be able to afford the repayments. This should include performing a hard search on your credit record to ensure you are capable of managing your finances. Even loans that advertise as affordable loans will need to have some sort of check on your credit rating, despite not being completely based on your score.

If you need an alternative, you could try guarantor loans, credit cards, or personal borrowing. Slickcashloan.com is a platform that connects potential loan borrowers with reliable and reputable loan lenders. It doesn't regulate the lending process hence isn't liable for the actions of the lenders. When possible, we chose loans with no origination or sign-up fees, but we also included options for borrowers with lower credit scores on this list. Many lenders have student loans designed for parents, many of which cover up to the full cost of a child's education and feature flexible repayment options.

Parents can also apply for a loan with a creditworthy co-signer. Under FCA guidelines, all loans providers should conduct some form of check on a borrower's credit score, even if they offer loans for affordability. This means that lenders should not be claiming to provide no credit check loans in the UK. Lenders should perform sufficient checks to ensure that you can comfortably make the repayments each month. If they do not check, there could be a chance that you cannot afford the repayments, leaving you in further financial difficulties. If you are looking for a way to secure the money you need, you could try a credit card or guarantor loan instead.

Without the proper checks carried out following FCA guidelines, no credit check loans from direct lenders present a serious risk to your finances. Creditworthiness and affordability checks are designed to protect you against financial difficulties. Any company offering short term or payday loans with no credit check is unlikely to have your best interests in mind.

It is usually a relief to find that some personal loan companies are willing to provide emergency loans for bad credit customers. Not many lenders agree to lend money to people with a minimum credit score lower than 620, considering that bad credit is not credible. Typically, lender choices for bad credit loans are few and difficult to find unless you know where to look. If you are looking for no credit check loans, Pheabs can help you find a number of loan options for people with bad credit and no credit scores. Customers can borrow $100 to $35,000, repaid over 1 to 60 months. Click on 'Get Started' to begin and receive an instant decision online.

Several providers offer the opportunity to prequalify you for a personal loan. This means you can submit details like your income information, desired loan use and housing situation to learn about potential loan limits, rates and repayment options. Prequalifying also only requires a soft credit check, which doesn't hurt your credit score, so you can safely find the best rates.

Getting a loan when you have bad credit or no credit history can be tough. Like most financial products, borrowers have to submit an application listing their income information and agree to a credit check before getting approved for a loan. No credit check for online loans will influence your FICO score. Keep in mind that your score will influence the number of offers you get and how favorable they are.

To apply, you need to be an American citizen of at least 18 years of age and have an active bank account. The positive news is that there are lenders on our panel that specialise in offering bad credit payday loans to those with poor credit. Also, our application process enables you to check if a lender is likely to accept your application or not, without hurting your credit score. We do this by carrying out a 'soft search' on your credit file. You can find out more about credit checks and soft credit searches below.

We respect your right to be fully informed before accepting a loan offer. Since your credit isn't pulled during the application, your credit score won't be affected by applying. When it comes to online loans with no hard credit checks, we can help borrowers out with payday loans online, installment and car title loans. When applying through cash advance apps you can loan with no credit…at least not one that can harm your FICO score.

All of our cash loans come with less stringent checks compared to a traditional bank which in turn gives you a higher probability of you getting a loan. People seeking loans with no credit check are often desperate making them a target for predatory lenders. If a lender is offering a loan with no credit check they are likely a title or payday lender offering a high interest loan for a short period of time.

These loans requiring a balloon payment on short terms can be dangerous. If a borrower cannot afford to repay the loan in full they are left with no option but to refinance that loan. This results in what regulators call the "cycle of debt," in which the entire balance of an initial loan is refinanced multiple times, to the borrower's detriment. A credit check from a lender with your financial success in mind is a good thing and a better option. There can be two types of inquiries into your credit history, often referred to as "hard credit check" and "soft credit check". A typical soft inquiry might include checking your own credit or online lenders that check your file to determine if they want to send you pre-approved loan offers.

Due to the impact of COVID-19 pandemic, many offline and online direct lenders are adjusting their services, including loan terms and application criteria. Some lenders have decreased their approval rates, while others consider additional factors when evaluating bad credit loan applications. This means that borrowers with a less positive credit history will face more limited borrowing options. Unlike the rest of the listed no-credit check loans websites, Credit Loan doesn't uniquely specialize in bad credit loans. However, it does offer its free services for people with bothgood or bad credit scores.

Keep in mind that getting a loan is always easier with a higher credit score, but overall, you can find a good deal on this website. Just because you have a bad credit score doesn't mean that you can only request a loan for the bare necessities. BadCreditLoans offers no credit check loans for many reasons. These reasons include but are not limited to business loans, auto loans, student loans, mortgages, and debt consolidation. An emergency doesn't look the same for everybody, and BadCreditLoans know it. That's why they are committed to offering good financial options to people that would otherwise struggle to get loans.

It is possible to get a student loan even if you have bad credit or no credit history. That said, it will be more difficult to qualify, and rates will be higher. Federal student loans are the easiest to qualify for, since most won't do a credit check and don't consider your credit score, and interest rates are the same for all borrowers. Choosing short term loans with no credit check involves the risk of being charged higher interest rates, default fees and charges. The risk may not be worth it, especially when there is a wealth of alternatives to payday loans from direct lenders with no credit checks available.

This may be beneficial to people who wish to 'shop around' for the best deals before committing to applying for any form of credit. In this way, brokers are acting similarly to a loan comparison site. Their aim is to help you find short term loans with no credit check upfront. However, brokers will only be able to provide you with pre-approval for bad credit loans with no credit checks.

We collected over twenty-five data points from more than fifty lenders before settling on our list of the best personal loans for bad credit. Some of the most important factors we considered included the interest rates, fees, loan amounts, and repayment terms offered by each lender. Plus, we evaluated the reputations of all of the lenders included on our list by reviewing a wide variety of sources. The borrowing party should never forget that applying for personal loans with a poor credit score can be very costly because of the high interest rates. You do not have much of a choice than to surrender to the lender's terms of short repayment duration and small amounts of loan.

While most loans require a credit check, there are some loans that don't. Instead, lenders qualify applications based on the applicant's ability to repay the loan. Lenders will likely also require collateral—a personal asset used to secure a loan and one the lender can repossess if the repayment terms are not met. You can get no-credit-check loans through payday loan stores, auto title lenders, online lenders and pawn shops. But it's unlikely borrowers with bad credit scores can qualify for these loans.

Most traditional lenders require minimum scores between 600 and 620. There might be a specialty lender or credit union that will make an exception, but it's not common. People with scores less than 600 would have to go through hard money lenders, such as private investors or companies, not a bank. While hard money lenders are more flexible, they're typically a more expensive route. If you're trying to cover higher education expenses, a student loan for bad credit is likely the direction you want to look. Although private student loans typically require good credit, borrowers with bad credit can take out federal student loans, which don't require a credit check.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.